my:Optima Secure Lite Health Insurance Plan

In today’s world, living without the protection of a health insurance plan is unthinkable. But increase in premiums for even a modest base sum insured is making it unaffordable for the majority in our country, especially for people living in tier 2 & tire 3 cities. At HDFC ERGO, we always believed in making health insurance accessible and affordable for one and all. So, we are introducing my:Optima Secure Lite, our latest addition to our health insurance lineup, designed to deliver accessible and effective coverage.

This new-age health insurance plan comes with an option to choose from two base sum insured – 5 lac & 7.5 lac. The my:Optima Secure Lite plan covers hospital expenses, day care procedures, pre- and post-hospitalisation services and other benefits as mentioned in the policy. It also comes with features like automatic unlimited restore, cumulative bonus and preventive health check-ups on renewal to ensure you get access to quality healthcare without any compromise. This plan is an ideal for people living in 2 tier and 3 tier cities looking for comprehensive coverage at affordable premiums.

Why You Should Choose my:Optima Secure Lite?

Choose An Adequate Sum Insured

You can opt for the two available options

my:Optima Secure Lite gives you the freedom to choose a base sum insured of 5 lac or 7.5 lac ensuring comprehensive coverage at affordable premiums.

Advanced Surgeries Covered

Encompasses all day care procedures

All Modern Treatments and Robotic Surgeries are covered up to Sum Insured under this plan.

Automatic Restore

Avail unlimited restore for a policy year

Instant addition of 100% of Base SI upon complete or partial utilization of Sum Insured.

Preventive Health Check-up

Keep track of your health status

Avail of annual health check-ups after completion of 1st policy year on both individual and family floater plans.

Optional Benefits With my:Optima Secure Lite Plan For Wholesome Gains

You can choose the below options while creating wholesome protection for you and your family with my:Optima Secure Lite plans.

Aggregate Deductible

You can work out a lower premium for the base sum insured you choose by choosing to pay a little during your claim settlements. With my:Optima Secure Lite you can avail up to 40% discount on your premium with the deductible amount mentioned in your policy.

Protect Benefit

By paying a little extra on your premiums you can be secured for coverage for 68 Non-Medical expenses listed by IRDAI so that your claims are paid to the last penny. Items like nebulizer kits, gloves, masks and others will be included in your claims.

Plus Benefit

To ensure comprehensive protection in the years that follow, you can opt for Plus Benefit where your base sum insured doubles post 2 policy Years. You can opt for this benefit during inception or renewal.

Existing Add-ons & Riders Available with Optima Secure Lite

Get more protection with the promise of my:Optima Secure Lite plan

-rider.svg)

Individual Personal Accident (IPA) Rider

This feature promises a lump sum payout to the policyholder in case of accidental death, or permanent or partial disability for a nominal increase in the premium providing IPA Rider 5 times the base plan sum insured max. up to INR 1 Crore.

Optima Well-being

This add-on feature provides an integrated cashless OPD healthcare solution where you can get unlimited in-clinic & tele consults with networked GPs, home sample collection, unlimited access to fitness classes and more. You can avail of these features exclusively through Here. app.

Critical Illness Add-on

For a little increase in your premium, you can get a lump sum payout on diagnosis of any of the listed 51 critical illnesses including various types of cancers, stroke, paralysis and more.

HDFC ERGO’s Promise – Making Health Insurance Accessible for All – An Ultimate Health Plan For Tier 2 & Tier 3 Cities

Benefits of Optima Secure Lite Health Insurance Plan

Essential Coverage Benefit

Unlimited Restore Benefit

Savings on your premiums

Freedom to choose a preferred base sum insured

Choose policy type & tenure

No restriction on age limit

Key Features

- Choose base sum insured: You can choose a plan with either 5 lac or 7.5 lac base sum insured and have wider coverage during a medical crisis

- Coverage for self and family: You can choose my:Optima Secure Lite on an individual or family floater basis for 1/2/3 years

- No max. age limit: While the eligibility criteria are 91 days for a dependable child and 18 years for an adult, there is no maximum age limit to ensure anyone opting for the plan is covered adequately.

- Coverage across the country: The plan is available in all metros, 2 tier and 3-tier cities

100% restore of base sum insured

Comprehensive coverage

Complete peace of mindfully

Key Features

- Restore benefit: Instant addition of 100% of Base SI upon complete or partial utilization of Sum Insured

- Coverage throughout the policy year: Restored amount shall be available only for subsequent claims that may arise during the remainder of the Policy Year

- Covers other family members mentioned in the policy: Restored amount can be used for the same or different illness or person covered under the policy.

Employee discounts

Loyalty discounts

Multi-individual discounts

Key features

- Employee discount: Get a 5% discount on your premiums if you are an HDFC Group OR Munich Re Group full-time employee

- Loyalty discount: Get a 2.5% discount if you have an active retail insurance policy with a premium above INR 2000 with us

- Multi-individual discount: Get a 10% discount if 2 or more family members are covered under 1 policy on an individual basis.

- Tenure discount: Get a 7.5% discount or a 10 % discount by making a one-time payment of 2 years or a 3-year policy respectively.

Why do Customers Trust Us?

Backed by the trust of #1.6 crore+ happy customers over the past 18 years. At HDFC ERGO, we consistently strive to make insurance affordable, easier and dependable. Here, promises are kept, claims are fulfilled and lives are nurtured with utmost commitment.

16000+ˇ Cashless Healthcare Networkˇ

₹17,750+ crores

Claims settled^*

1 claim processed every minute^^

24x7 support in 10 languages

1.6 Crore+

Happy Customers@

99% Claim

Settlement Ratio^

Know How Optima Secure Lite Benefits Boost Your Health Cover?

Comprehensive coverage'*

Choose your preferred base sum insured

Choose your preferred base sum insured

my:Optima Lite, is the latest addition to our health insurance lineup, designed to deliver accessible and effective coverage. This new-age health insurance plan comes with an option to choose from two base sum insured – 5 lac & 7.5 lac. It is thoughtfully designed to ensure comprehensive health coverage for an adequate base sum insured.

How does it work?

For your preferred base sum insured plan, you get extensive coverage for hospital expenses and other benefits as mentioned in the plan.

Plus Benefit

100% increase in coverage after 2 Years

100% increase in coverage after 2 Years

We love the fact that you are choosing us to be your partner on your health journey. And, hence we would love to reward you for your trust and loyalty by offering a 50% increase in base cover at first renewal and a 100% increase post-2nd-year renewals irrespective of any claims made.

How does it work?

When Mr Sharma renews his Optima Secure Health Insurance Plan for 1 year, Plus Benefit increases his base cover of ₹10 lacs by 50% and in 2nd year by 100%, making it ₹15 lacs and ₹20 lacs respectively. Plus benefit and secure benefit together takes the total coverage to ₹30 lacs.

Automatic Restore Benefit

100% Restore Coverage~

100% Restore Coverage~

Optima Secure plan restores up to 100% of your base sum insured for subsequent claims, for any illness or accidental hospitalisation. This benefit comes in handy when you exhaust your existing sum insured due to one or several claims.

How does it work?

Imagine a situation where Mr. Sharma claims partial or total ₹10 lacs base cover, it gets 100% restored, making it ₹30 + ₹10= ₹40 lacs. So, he does not have to limit his claims to ₹10 lacs base cover or ₹20 lacs secure benefit, he will get an additional ₹10 lacs as a restore benefit to settle claims.

Protect Benefit

Zero Deductions on Non-medical expenses'*

Zero Deductions on Non-medical expenses'*

It is the non-medical expenses that really end up burning a hole in your pocket. Well, we have got your back. Go cashless with our my:Optima Secure health plan which has an in-built coverage for listed non-payable items like gloves, masks, food charges, and other consumables during hospitalisation. Usually, these disposable items are not covered by insurance policies or offered as an optional cover at an additional cost. However, with this plan, all your expenses for 68 listed non-medical items that are commonly used during hospitalisation are covered at no extra premium.

How does it work?

During hospitalization, his non-medical expenses that add up to 10-20% of the total bill amount also get covered by Protect Benefit. With Optima Secure plan you can rest assured that as many as 68 non-medical expenses will be taken care of. Mr. Sharma won't have to shell extra pennies for these non-medical expenses. Items like disposables, consumables, and non-medical expenses such as gloves, food charges, diapers, belts, braces etc will all be covered under this plan.

Day Care Treatments Covered

No restriction on procedures

No restriction on procedures

Cost for advanced medical treatments or surgeries taken under general or local anesthesia completed within 24 hours are covered. The plan also covers all modern treatments and robotic surgeries excluding cosmetic & experimental procedures.

How does it work?

One can get coverage up to the base sum insured for daycare procedures.

What is Covered By Optima Secure Lite Health Insurance Plan

Hospitalisation Expenses

The plan covers medicines, investigative treatments and diagnostic procedures along with surgeon, anaesthetist, medical practitioner, consultants, specialist fees along with other expenses as mentioned in the policy.

Pre and Post Hospitalisation

Instead of the 30&90 days availed normally, get 60 & 180 days of pre and post-hospitalisation medical expenses covered for seamless recovery.

All Day Care Treatments

Medical treatments or surgeries taken under general or local anaesthesia completed within 24 hours are covered under this plan. All modern treatments and robotic surgeries are covered upto Sum Insured under this plan, except for cosmetic or experimental procedures.

Organ Donor Expenses

The plan covers the cost of the organ donor’s hospitalization for harvesting of the donated organ where an insured person is the recipient.

AYUSH Treatment

Respecting your belief in alternate medicine we cover medical expenses for inpatient care* under Ayurveda, Yoga & Naturopathy, Unani, Siddha, Homeopathy in an AYUSH hospital where the stay exceeds 24 hrs.

Domiciliary Hospitalization

If prescribed in writing by the treating medical practitioner medical expenses incurred for availing medical treatment at home is covered if the insured cannot be moved/admitted to a hospital or due to non-availability of room in a hospital.

Daily Cash for Shared Room

If admitted in a network hospital on shared accommodation for more than 48 hrs, the plan entitles the insured to a fixed daily cash amount for out-of-pocket expenses. It can go up to INR 800 per day max. up to INR 4800.

Ambulance charges

Under the my:Optima Lite plan road ambulance charges are covered and air ambulance charges up to 5 lac per hospitalisation can be claimed.

E-opinion for Critical Illness

We provide a second opinion from our panel, for a listed critical illness suffered during the policy year. This benefit can be availed only once in a policy year. It is available for each insured person in case the policy is issued on a floater basis.

Unlimited Restore

This plan provides unlimited instant addition of 100% of base SI upon complete or partial utilization of the sum insured. The restored amount shall be available only for subsequent claims that may arise during the remainder of the policy year for the same or different illnesses or persons covered under the policy.

Please read the policy wordings, brochure and prospectus to know more about my Optima Secure Lite.

Adventure Sport Injuries

Adventures can give you an adrenaline rush, but when coupled with accidents, it can be hazardous. Our health insurance plan does not cover accidents encountered while participating in adventure sports.

Breach of Law

We do not cover expenses for treatment directly arising from or consequent upon any insured person committing or attempting to commit a breach of law with criminal intent.

War

War can be disastrous and unfortunate. However, our health insurance plan does not cover any claim that is caused due to wars.

Excluded Providers

We do not cover expenses incurred towards treatment in any hospital or by any Medical Practitioner or any other provider specifically excluded by the Insurer. (Contact us for list of de empanelled hospital)

Congenital external diseases, defects or anomalies,

We understand that treatment towards congenital external disease is critical however, we do not cover medical expenses incurred for Congenital external diseases defects or anomalies.

(Congenital diseases refer to birth

defects).

Treatment for Alcoholism & Drug Abuse

Treatment for Alcoholism, drug or substance abuse or any addictive condition and consequences thereof remains uncovered.

16000+

Cashless Network

Across India

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

Roopali Medical

Centre Private Limited

Address

C-1/15A Yamuna Vihar, Pincode-110053

Jaslok Medical Centre

Address

C-1/15A Yamuna Vihar, Pincode-110053

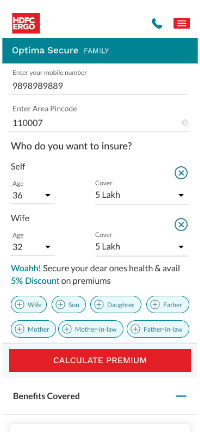

How to Calculate Your Health Insurance Premium

How to Make a Claim for your HDFC ERGO Health Insurance

The sole purpose of buying a health insurance plan is to get financial support at the time of medical emergency. Hence, it is important to read the below steps to know how Health Insurance claims process works differently for cashless claims and reimbursement claim requests.

2 Claims processed every minute^^

Intimation

Fill up the pre-auth form at the network hospital for cashless approval

Approval/Rejection

Once hospital intimates us, we send you the status update

Hospitalisation

Hospitalisation can be done on the basis of pre-auth approval

Claim settlement

At the time of discharge, we settle the claim directly with hospital

2 Claims processed every minute^^

Hospitalisation

You need to pay the bills initially and preserve the original invoices

Register a claim

Post hospital discharge send us all your invoices and treatment documents

Verification

We verify your claim related invoices and treatment documents

Claim Settlement

We send the approved claim amount to your bank account.

Believe in Alternate Medicines? Get Coverage For The Same With Optima Secure Lite

Read Latest Health Insurance Blogs

Frequently Asked Questions on Optima Secure Health Insurance

1. How many members can be covered under the Optima Lite Plan?

In an Multi-Individual Policy, a maximum of 6 adults and a maximum of 6 dependent children can be included in a single policy on individual sum insured basis. List of relationships which can be included is mentioned below:

• Spouse

• Son

• Daughter

• Father

• Mother

• Father-in-law

• Mother in-law

• Daughter-in-law

• Son-in-law

• Grandfather

• Grandmother

• Grandson

• Granddaughter

• Brother

• Sister

• Sister-in-law

• Brother-in-law

• Nephew

• Niece

In a family floater policy, a maximum of 4 adults and a maximum of 6 dependent children can be included in a single policy on floater Sum insured basis. The 4 adults can be a combination of self, spouse, parents and parents-in-law.

2. What sum insured options available under the Optima Lite Plan?

The Sum Insured options available under Optima Lite Plan in Lacs are 5Lac & 7.5Lac only

3. How do you calculate the premium of a Family Floater Policy?

In the Family floater option, the eldest member of the particular family composition will pay full premium as per the individual premium based on his/her respective age. Thereafter, a floater discount of flat 55% will be applied on the individual premiums of every additional member excluding the eldest member in the Policy.

4. There is a constant increase in price with each age point. Why not keep an age banded pricing?

Premiums in this product are calculated on specific age basis rather than age band basis. Hence there will be a marginal increase in premium every year. This will help to avoid situations of sudden premium jump when age band changes in band wise premiums approach. Such jumps are steep and seen especially at higher ages.

5. What are the policy tenures available and discounts applicable on long-term policy tenure?

Discount of 7.5% shall be provided if a policy is purchased for 2-year policy tenure and the premium is paid in advance as a single premium. Discount of 10% shall be provided if a policy is purchased for 3-year policy tenure and the premium is paid in advance as a single premium.

6. How will Automatic Restore Benefit (unlimited times) work exactly?

Automatic Restore Benefit is an in-built benefit in our Optima Lite Plan. It triggers upon partial or complete exhaustion of sum insured in a policy year. An amount of up to 100% of base sum insured is provided under this benefit. This amount shall be made available only for subsequent claims that might arise during the remainder of the policy year. Restorations of up to sum insured shall be provided unlimited times in a policy year and every time a claim is paid.

7. When will Automatic Restore Benefit (unlimited times) trigger?

Automatic Restore Benefit (unlimited times) triggers every time upon partial or complete exhaustion of sum insured in a policy year by way of an admissible claim.

8. Can Automatic Restore Benefit be triggered for the same illness and same person as well?

Yes, Automatic Restore Benefit can be availed for the same illness and for the same person as well.

9. Can the remaining amount under Automatic Restore Benefit be carried forward?

No. The amount restored shall be made available only for subsequent claims that might arise during the remainder of the policy year. If not utilized, this amount shall not be carried forward to subsequent policy years.

10. Is there any important condition applicable to Unlimited Restore Benefit?

Yes. A single claim in the policy year shall never exceed the cumulative addition of

• Base sum insured (in monetary terms at the start of the year)

• Cumulative Bonus (if applicable and remaining during the policy year),

• Plus Benefit (if applicable and remaining during the policy year)

Car Insurance

Car Insurance  Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Health Insurance

Health Insurance  Pet Insurance

Pet Insurance

Travel Insurance

Travel Insurance  Home Insurance

Home Insurance  Cyber Insurance

Cyber Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural  Critical illness Insurance

Critical illness Insurance